Recent Rent Declines and Rising Vacancy Are Making Owners More Cautious

By Ryan Patap

CoStar Analytics

December 8, 2023 | 8:06 A.M.

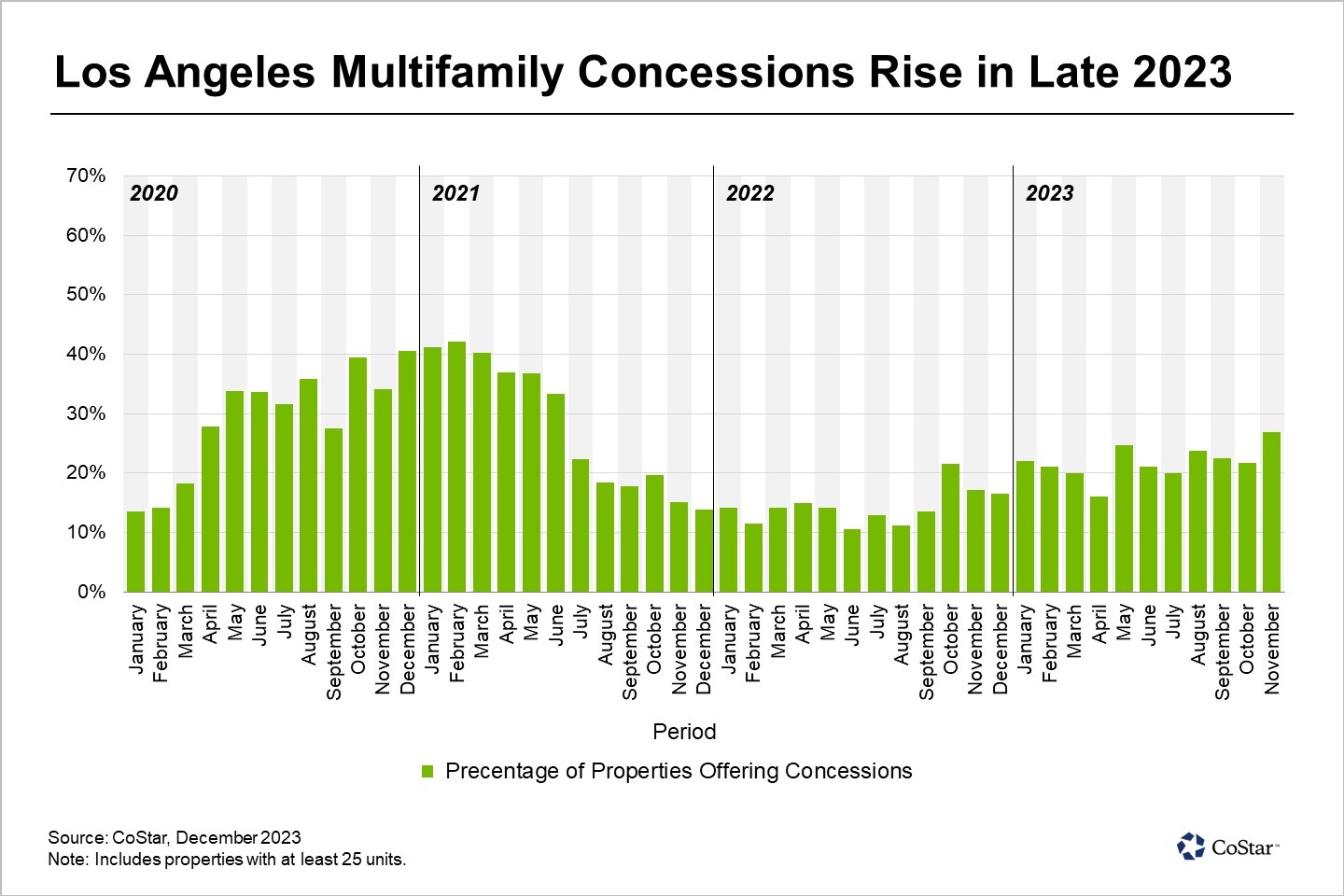

The percentage of Los Angeles multifamily properties offering concessions rose in November, with 27% of properties with 25 or more units providing some level of incentives during the month — the highest level since June 2021.

Last month’s increase in concession offerings coincides with apartment rents peaking in late August before beginning a three-month decline. During November, average asking rents on a per-square-foot basis declined by 0.3%. This follows 0.5% and 0.3% declines in September and October, respectively.

Demand for apartment units year to date has been relatively soft across the Los Angeles market, with a tenant net absorption, defined as the net change in unit occupancy, of 5,800 units. Over the past decade, the market has seen an average of 8,000 units absorbed annually.

At the same time, over 11,000 market-rate units have been completed so far in 2023, similar to completion levels over the past five years. Vacancy, 4.9%, is up from 4.4% at the start of this year.

Concessions on offer range from something as small as a waived application fee to larger options, such as eight weeks of free rent on a newly signed, 16-month lease in certain locations that have a surplus of new units, including downtown Los Angelesand Koreatown.

Apartment landlords and property managers are becoming more cautious at the end of the year. CoStar expects continued soft renter demand into the start of 2024. Given this outlook, concessions may rise further in the near term.