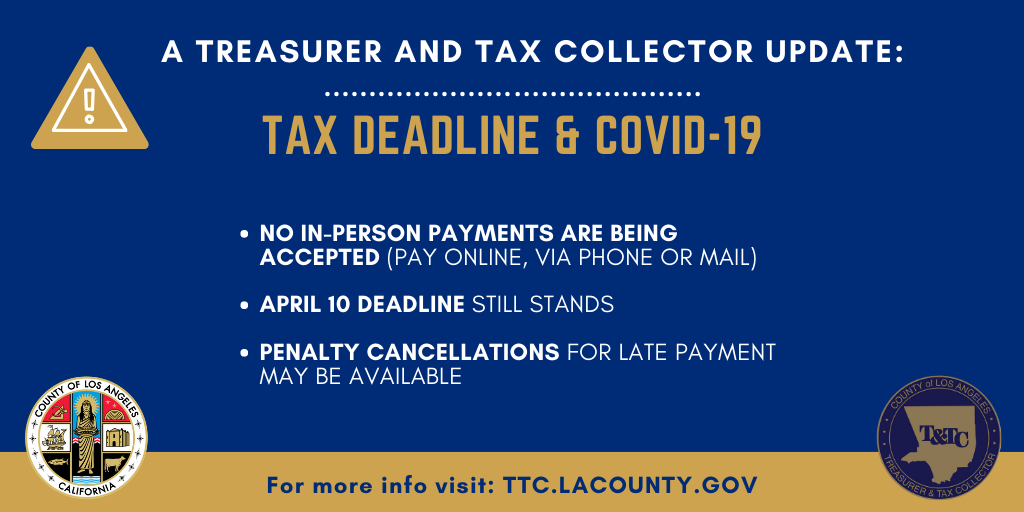

Statement from Keith Knox, Treasurer and Tax Collector on COVID-19 and April 10 Property Tax Deadline

Si desea obtener información adicional sobre este aviso o si necesita la información traducida en español, por favor llame al 1(213) 974-2111 entre las 8:00 a.m. y 5:00 p.m. Tiempo Pacífico, de lunes a viernes, excluyendo los días festivos del Condado de Los Ángeles. “I understand that this is a very stressful time, especially for those suffering direct effects from this public health crisis, and my office is committed to helping in any way we can. Los Angeles County property owners affected by the COVID-19 virus may have late penalties cancelled if they are unable to pay their property taxes by the April 10 deadline. We have no authority to extend the April 10 deadline, as outlined by State Law. However, beginning on April 11, the day after property taxes are due, people unable to pay on time for reasons related to COVID-19 may submit a request for penalty cancellation online. The department has set up a special team to process these requests for those who demonstrate they were affected by the outbreak.

We encourage all property owners who can pay their taxes on time to do so. This revenue helps keep the government running and providing vital services that the public relies on, especially in times like these.

Since County buildings are currently closed to the public during this emergency, there will be no in-person payments. Instead, taxpayers can pay online, via telephone or by mail. There is no cost for e-Check payments online. For online credit/debit card transactions, our card payment processor charges a 2.25 percent service fee.

We have developed responses to our most Frequently Asked Questions (FAQs).

Please click here for our FAQsTaxpayers can also visit https://ttc.lacounty.

gov/, to review payment methods and several other online self-service options. Taxpayers may also call (213) 974-2111 for additional information”

info@scott.properties.com

CURRENT RESIDENTS/CLIENTS:

310-260-6363

ARE YOU AN OWNER LOOKING FOR

MANAGEMENT SERVICES?

424-272-6439

310-260-6363

ARE YOU AN OWNER LOOKING FOR

MANAGEMENT SERVICES?

424-272-6439

Never Miss a Thing,

Sign up for our Newsletter!

Sign up for our Newsletter!